About the Video: In the above video, Steve Wathen, founder and CEO of Equity and Equity Construction Solutions (ECS) discusses how COVID-19 has affected the commercial real estate industry.

Description: COVID-19 has affected all of us throughout the past several months. On a personal level, it has changed the way we shop, how we order dinner— all while maintaining a six feet distance from others. From a business standpoint, COVID-19 has also made a substantial impact. It has impacted all sectors in some way including the food, retail, general office, and commercial real estate industry.

Transcription of Video

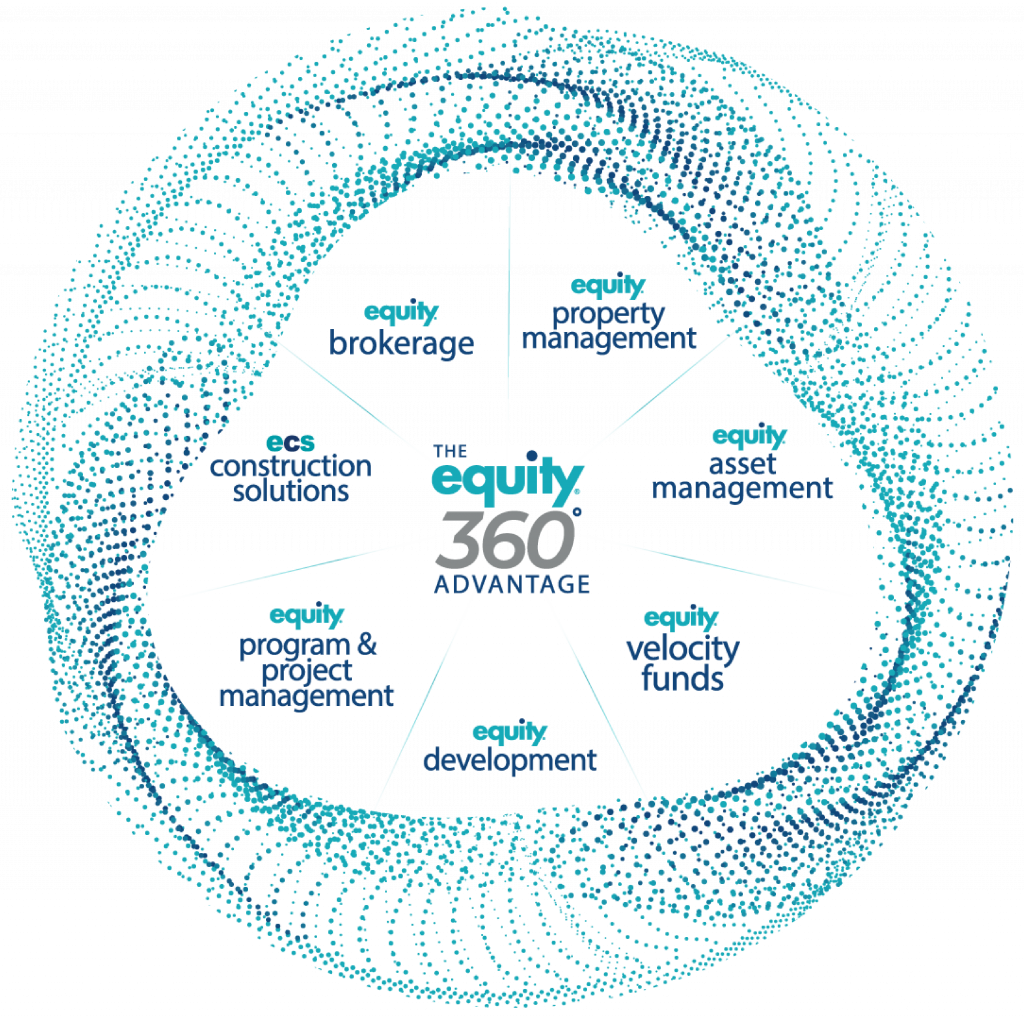

Hi, my name is Steve Wathen. I’m the founder and CEO of Equity and ECS. Our company is a full service commercial real estate company headquartered in Columbus, Ohio with offices in seven cities across the U.S. and activity across all the states of the U.S.

Like so many of you, we’ve been dealing with COVID-19 the last few months and into the next several months. I’ve been asked a lot of questions on a fairly regular basis and I thought I would attempt to answer those today and share them with you.

How has COVID-19 affected the commercial real estate industry?

The first thing that impacted us was tenancy. With the shut-down of businesses, which was one of the first major reactions of local governments (shutting down restaurants and public events and all of that sort of thing), well those occurred in commercial real estate.

There are tenants, they pay rent, and so forth. And of course their businesses were immediately shut down. That compromised their ability to pay rent. With that, it was almost simultaneous- there was somewhat of a panic among the commercial banks. That affected the capitalization of commercial real estate.

The understanding that with tenants potentially not paying rent, landlords or building owners would potentially not be able to make their debt service and payments to the bank. There was kind of a dual thing going on in terms of our reaction. Of course, it was dealing with those tenants, seeing who could pay, who would pay, who wouldn’t, and of course subsequently dealing with our lenders to make sure that we had adequate arrangements with them to survive whatever lack of income might occur at the property level.

On the other side, outside of the real estate portfolios, commercial real estate companies, were impacted on operations particularly in things like brokerage, development: things where large commitments of capital have to be made. In order for those things to occur, businesses across all industries stopped or slowed decision making processes as they dealt with their own issues related to COVID.

We saw leasing activity go to near zero for several weeks. We saw new transaction activity again, even transactions in process get slowed. As I mentioned earlier, the banks were concerned and remained concerned about the outcome from COVID. So, transactions and development projects that were even in the mid-stream process of being funded or even had full commitments got slowed in terms of movement towards closing and so-forth.

Again, it’s impacted the [commercial real estate] industry pretty much at every level.

Have certain industries been impacted more than others?

Among the industries impacted by COVID, at least as it relates to our purview which is commercial real estate, I’d say retail clearly is the worst: the most heavily impacted. The closures were so dramatic. The sole source of income for retailers usually, at least bricks and mortar retailers, are people walking into their stores and buying things. Restaurants of course, if you can’t walk in and purchase food, it’s very very difficult. There’s an economic proposition for them as well.

Retail clearly is the most impacted. Second, I would say is general office. And that might even bleed in a little to healthcare. As much as we all view COVID as a healthcare crisis that might precipitate more consumption in healthcare, that really wasn’t the case. Elective surgeries- things that had to be stopped in order to make room in hospitals and create capacity to deal with a potential COVID-explosion- required that those physician activities halt along with other retail, restaurant, and other activities. We even had a number of healthcare facilities across the country affected by this.

How will the commercial real estate industry evolve due to COVID-19?

The real estate industry, like every other industry, evolves somewhat due to COVID. We evolve anyway regardless as circumstances change. COVID has brought things to light and perhaps accelerated certain industries and dampened others in such a way that some of those effects will be immediate. When I say immediate, perhaps it’s more a comment that those sectors are changed now and won’t fully recover to the status or circumstance they had prior to COVID.

First is retail. I mentioned earlier that retail was a very hard hit, but that’s really bricks and mortar. The e-commerce retails flourished during COVID. We all watched the numbers, the growth numbers, in the first quarter of 2020 with Amazon and other e-retailers just skyrocket. That’s going to have a long term effect. What’s happening is we’re changing habits: consumer habits. Things that they [consumers] might have gone to the store to buy before, they’ve become accustomed to ordering online. So there will be somewhat of a dampening effect there, but again, that’s just a trend. That trend has been going on for many years. COVID was just an accelerator of that.

Some other areas would be industrial. Industrial will continue to flourish. It was flourishing before COVID, but again an accelerator with e-commerce. E-commerce drives a tremendous amount of industrial absorption and demand. I think we’ll see that those numbers will remain very strong.

Another effect is general office. We all had to work from home for some period of time: some industries longer than others. People became accustomed to working from home. We’ve actually seen across many industries that utilize general office that the productivity is actually improved with employees working at home. Whether or not that remains the case is yet to be seen: if employees working long term from home can maintain those productivity figures.

How did Equity respond to the COVID-19 pandemic?

Within two weeks of the real onset of the most problematic measures in the pandemic- those being office closures, restaurant closures, and so forth- within two weeks, we actually moved to an aggressive, we called it our “offensive posture.” That we were not just getting back to what we did before, which was aggressive marketing, promotion of our business, pursuit of new business, execution of our current business, but we divided to take much more aggressive posture than in the past because we were sailing into such difficult headwinds. Interestingly, there was a lot of rejection on the phone. I made lots and lots of phone calls, trying to engage customers and others in conversations about the future. Those first few weeks, people thought we were crazy. Why are you calling us? We are dealing with a crisis. We are dealing with a pandemic.

But it’s interesting: the following month when we called them, they remembered that first call and we moved forward. We started to have discussions. We helped a lot of our clients start to think about their future.

The future is full of hope. The future is a very positive place. And it helps remove us from the current malaise we’ve been dealing with. We are emerging very steadily; I wouldn’t say quickly. Certainty with or at, perhaps beyond the pace of the market recovery and we expect that to continue.

In closing, I hope all of you are dealing with your COVID-19 issues as we are: trying to take a positive mental attitude, emerge from this together. If there is anything we can help you with in regards to commercial real estate, we’re happy to be there, to come along side and help you through that. Thanks again for your attention.